Amortization are an accounting label you to means the alteration in the worth off intangible possessions otherwise economic tool throughout the years. If you have ever wondered how much of your monthly payment often go on the attract as well as how far goes into dominating, an amortization calculator is a straightforward way of getting you to advice.

Money, including, varies when you look at the value depending on how far appeal and you can dominant remains to be paid. An amortization calculator is hence utilized for understanding the enough time-title price of a predetermined-speed home loan, since it reveals the dominating which you yourself can spend across the life of the mortgage. Also, it is ideal for finding out how your own mortgage payments is planned.

Key Takeaways

- When you yourself have a completely amortized mortgage, such home financing otherwise an auto loan, you will pay the exact same amount per month. The financial institution often implement a gradually less part of their fee towards attention and a gradually larger part of their fee to your the principal before the mortgage try paid.

- Amortization hand calculators allow easy to understand just how good loan’s month-to-month costs was split up into interest and you will dominant.

- You can make use of a consistent calculator otherwise a good spreadsheet doing their amortization math, but an amortization calculator offers a more quickly result.

Guess Their Monthly Amortization Payment

Once you amortize that loan, you only pay it off gradually as a consequence of occasional payments of interest and you may prominent. A loan that is thinking-amortizing would-be totally paid back once you make the last periodic fee.

The newest periodic money will probably be your month-to-month dominant and you can appeal payments. For every single payment per month could be the same, nevertheless the count you to would go to focus tend to gradually ount one goes to dominating often slowly increase every month. The ultimate way to guess your own month-to-month amortization percentage is by using an enthusiastic amortization calculator.

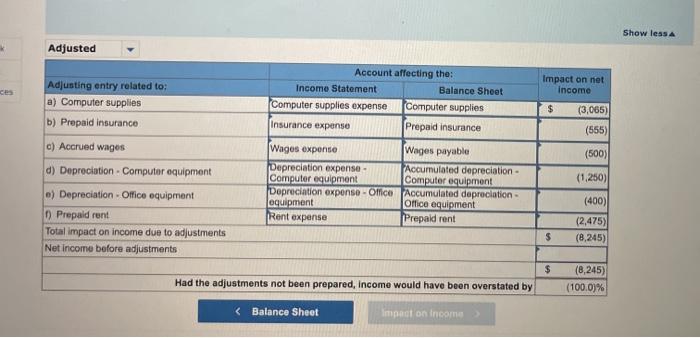

Amortization Calculator Results Explained

- Amount borrowed: Exactly how much do you really bad credit loans Sacramento plan to borrow, otherwise just how much have you ever already lent?

- Mortgage term: Just how many many years is it necessary to pay back the loan?

- Interest rate: What’s the bank asking a year toward mortgage?

Including, in case your mortgage was $150,000, your loan name try three decades, and your interest is step three.5%, after that your monthly payment might be $. The new amortization plan might assist you your complete focus more 3 decades could well be $ninety five,.

What is an Amortization Agenda?

A keen amortization agenda offers a complete report on most of the month-to-month fee, showing exactly how much goes to dominant and how far goes to desire. it may reveal the entire attract you will have paid at a given area during the longevity of the borrowed funds and you will what your principal balance could be at any point.

Utilizing the same $150,000 loan example off over, a keen amortization schedule will show you that basic monthly payment commonly consist of $ into the prominent and $ during the attention. Ten years afterwards, their percentage is $ for the principal and $ inside notice. Your final payment per month immediately after thirty years gets less than $2 going for the interest, towards the sleep paying the past of your own dominating harmony.

That loan amortization schedule try computed with the amount borrowed, mortgage label, and interest. If you know these types of about three things, you need to use Excel’s PMT form in order to assess your payment. Within example significantly more than, all the details to get in in a be noticeable telephone was =PMT(step three.5%/12,360,150000). The outcome might possibly be $.

Knowing your monthly payment, you might calculate how much of one’s payment per month is going for the dominating as well as how far is certian on the focus with this particular formula: